በጤና ባለሞያዎችና በባንክና ፋይናንስ ባለሞያዎች አማካይነት ያቀረብናቸውን በርካታ የመረጃ ፕሮግራሞችን ቪዲዮዎች ለመመልከት እዚህ ይጫኑ

Helpful Resources for Jobs and Small Business Assistance

Current Environment- https://www.usatoday.com/story/money/2020/06/22/cares-act-600-unemployment-other-covid-19-relief-set-end/3211921001/

- USA Today article on expiration of the extra jobless benefits

- https://www.charlotteobserver.com/news/business/article243657997.html

- Charlotte Observer article noting 956 employees in Charlotte have been affected by cost cutting measures impacting six Marriott-owned hotels (goes to local impact)

- https://www.charlotteobserver.com/article241349511.html

- Charlotte Observer article noting over 600 employees at Charlotte Douglas who work for concessions (HMSHost) were either laid off or furloughed (goes to local impact)

- City of Charlotte – Housing and Neighborhood Services

- https://charlottenc.gov/HNS/CE/Youth/Pages/Youth-Jobs.aspx

- Website that is frequently updated with a list of companies that are hiring during COVID-19 and links to the specific company websites

- Broad range of employers represented, e.g. Advanced Auto Parts, Ally, Amazon, Charlotte-Mecklenburg Schools, Lowes, Securitas, UPS, etc.

- Additionally, the site contains links to Career Information such as updating resume, preparing for a video interview and other tips

- Also provides links to organizations offering free training and online courses

- Charlotte Works

- https://www.charlotteworks.com/services/career-services/

- Workforce development board serving Mecklenburg County

- Focus on ensuring that job seekers have access to opportunities, and have the skills the employers need

- Provide services at no cost including resume / interview preparation, essential skills training and coaching and on-site computers for job searches

- Goodwill – Job Connections

- https://goodwillsp.org/train/career-development/

- Services are being offered solely online and by phone (704-372-3434)

- Offer a range of career development resources such as resume development, career counseling, computer basics and interviewing tips

- Additionally, through Goodwill University (https://goodwillsp.org/train/goodwill-university/) offer a range of free virtual training on topics such as IT, Microsoft Office, and customer service

- Access to Capital Small Business Recovery Grant Program

- https://www.fftc.org/CLTcitygrant

- $30mm grant program that will provide grants of between $10K to $25K to Charlotte-based small businesses impacted by COVID-19

- Applications are being accepted through July 31st

- Programs will distribute $15mm for microbusinesses (those with 5 or fewer employees) and $15mm for small businesses (those with 6 to 25 employees)

- Microbusinesses are eligible for grants up to $10K; Small businesses are eligible for grants up to $25K

- Checks will be issued on June 30th, July 6th and August 3rd for eligible businesses and may be used for 1) rent / mortgage, 2) utilities, 3) employee salaries / benefits and 4) supplies

- To qualify, small business must be

- headquartered in city limits and established before Jan 1, 2020

- employ 25 or fewer employees (incl. part-time, if reported on company’s W3)

- generate at least $30K in annual revenue, but no more than $2mm

- City of Charlotte – COVID-19 Mortgage Relief Assistance Program

- https://charlottenc.gov/HNS/Housing/Homeowners/Pages/Charlotte-Mortgage-Relief-Assistance-Program.aspx

- City and Charlotte-Mecklenburg Housing Partnership providing assistance to homeowners who need help with their mortgage due to COVID. Provided on first come, first serve basis

- Focus is on homeowners with an income of up to 80% of Area Median Income (AMI) who have experienced loss of income due to COVID

- Program provides for up to 3 months of mortgage payments as a grant to qualified participants

- Must have been current on mortgage prior to COVID

- JT to call The Housing Partnership (704-343-4692) and affirm program status

- Small Business Emergency Stabilization Loan Fund

- https://carolinasmallbusiness.org/initiatives/covid-19-small-business-emergency-stabilizationloan-fund/

- Partnership between Mecklenburg County and the Carolinas Small Business Development Fund

- [Have email in to program coordinator to confirm current status]

- Fund is structured as a loan (not a grant) to provide financing from $5,000 to $35,000 for qualifying small businesses that have been adversely impacted by pandemic

- Loan structure:

- Interest rate of up to 3%

- Terms of up to 10 years

- Interest-only payments for the first 12 months

- No collateral requirements

- No application or processing fees

- Business premises must be physically located in Mecklenburg County, have 50 or fewer FTE employees and have been in operation for at least 24 months

- Documentation requirements are listed on the site

CARES Act Help for Small Business Owners

CARES Act Overview

– On 3/27/2020 Congress passed and the President signed the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”)

– The law provides more than $2T in emergency economic relief to individuals and businesses affected by the virus crisis through numerous new stimulus and aid programs

– Law is innovative in targeting aid as quickly as possible to individuals and businesses

Paycheck Protection Program (“PPP”)

What is the PPP?

– One of the particular programs that will be administered by the Small Business Administration (“SBA”) is the PPP

– The CARES Act provides for $349B in funding for loans through the PPP, an expansion of the SBA’s existing 7(a) loan program aimed at supporting small businesses and encouraging those businesses to retain their workers

How does it work?

– Loans made under the PPP can be used to cover costs incurred during the period from Feb 15th to Jun 30th; the SBA has authorized lenders to start processing PPP loan applications on April 3rd

– The main objective is to keep small businesses operating and their employees working

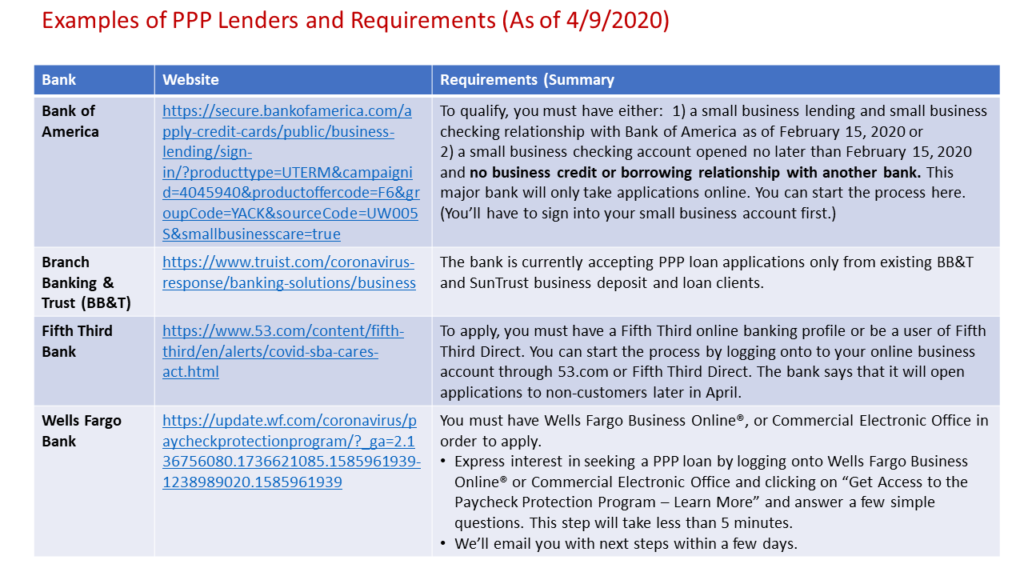

– PPP applications are submitted through a bank, not directly with SBA

– Businesses must apply to the bank where they have their business depository relationship (over 800 institutions in network)

– In addition to the application, borrowers must submit documentation necessary to establish eligibility such as:

o payroll processor records

o payroll tax filings or Forms 1099

– To be eligible for a loan an applicant must:

o Have a place of business in the U.S.

o Operate primarily in the U.S. or make a significant contribution to the U.S. economy through tax, labor and use of products

Who is eligible for PPP?

Small businesses, including sole proprietors, independent contractors, self-employed individuals, nonprofit organizations, tribal business concerns, and Veterans’ organizations, that:

- Employ 500 or fewer people

- Were in business on or before February 15, 2020

- Had employees to whom they paid salaries and for whom they paid payroll taxes or that paid independent contractors

- Have a business checking account as of February 15, 2020

Therefore, in our community, this would include:

– Hairdresser/beauty supply stores

– Convenience stores

– Uber/taxicab drivers

– Home care providers

– Truck drivers

– Churches and religious institutions

How much can a business receive?

· Maximum loan amount is 2.5x a business’ average total monthly payroll amount for calendar year 2019

· “Payroll costs” include salary, wages, tips, commissions, paid leave benefits, employer-paid health insurance premiums, and state and local payroll taxes.

What are the terms of the loan?

– The SBA has waived all otherwise applicable 7(a) fees for PPP loans, and interest rates will be 1%

· No collateral requirements or personal guarantees are required

· At least 75% of PPP loan proceeds must be used for “payroll” costs

· Recipient can use loan proceeds to cover: payroll costs (e.g. salary, wages, medical and retirement benefits), mortgage interest payments, rent, utilities and interest on loans obtained prior to 2/15/20

· An applicant must certify in good faith that the loan will only be used to cover allowed costs

· Under the PPP, a business must certify on its application that, it has not and will not receive another PPP loan

– Lenders must make that payout no more than 10 calendar days after the loan is approved, the agency said.

Can PPP loans be forgiven?

– Subject to certain limitations, a PPP loan is eligible for forgiveness up to the amount spent by the borrower in the eight-week period after the origination date of the loan

o Payroll costs, interest payments on any mortgage obligation, payment of rent on any lease and / or payment of any utility – in each case that was in place prior to 2/15/20

– Forgiveness of non-payroll costs is limited to 25% of the total forgiveness amount

– The amount of eligible loan forgiveness will be reduced proportionally by the number of employees laid off, and similarly if employees’ salaries are reduced by more than 25%

– Repayment over two years at 1% interest rate

Expanded Economic Injury Disaster Loan program (EIDL)

Overview:

· Small business owners in all U.S. states are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

· This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue.

· Funds will be made available following a successful application. This loan advance will not have to be repaid.

· $1,000 per employee for up to 10 employees

Eligibility:

· Many applicants said they have been told that initial disbursements will be capped at $15,000 per business. S.B.A. representatives did not respond to repeated questions about whether caps have been imposed.

· Does this program offer loan forgiveness?

o Partly. Businesses can request up to $10,000 of a disaster loan as a grant. It’s described on the application as a “loan advance,” but S.B.A. officials confirmed that it did not have to be repaid. Borrowers will be on the hook for the rest.

What do I need to know about repayment?

· The rest of the loan can be repaid on a term of up to 30 years. The interest rate is 3.75 percent for small businesses and 2.75 percent for nonprofits. No payment is due for the first year.

SBA Express Bridge Loans

Overview:

· Enables small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 quickly.

· Express Bridge Loan Pilot Program allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 quickly.

· These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing and can be a term loans or used to bridge the gap while applying for a direct SBA Economic Injury Disaster loan.

· If a small business has an urgent need for cash while waiting for decision and disbursement on an Economic Injury Disaster Loan, they may qualify for an SBA Express Disaster Bridge Loan.

SBA Debt Relief

Overview:

The SBA will automatically pay the principal, interest, and fees of current 7(a), 504, and microloans for a period of six months.

The SBA will also automatically pay the principal, interest, and fees of new 7(a), 504, and microloans issued prior to September 27, 2020.

For these loans, you don’t request an amount. The S.B.A. will determine how much you can borrow using a formula intended to approximate six months of your operating expenses.

The loans cannot be used to refinance previous loans; anything else is fair game. If you use money from a disaster loan to pay your employees, you can try to refinance through the paycheck protection program, which allows for the loan to be forgiven.

Facts about COVID-19

COVID-19 (also called “coronavirus”) is a novel virus, meaning it is NEW. there is no medication or vaccine to prevent the spread of COVID-19. The virus is spread through the air (i.e., coughing or sneezing) and contact (live outside of the body or unclean surfaces for up to 2 weeks).

High-Risk Population

- If you’ve had contact with a symptomatic person who has been diagnosed with COVID-19 or has traveled to an area affected by a COVID-19 outbreak.

- Infants and the Elderly (ages 60 and up)

- Compromised immune ( Anyone who is receiving chemotherapy, radiation or organ transplant/maintenance )

- Chronic Disease (cardiac, lung or

renal)

- Diabetes patients * High blood sugars might be the first indication of a symptom. Please check your blood sugars frequently.

Symptoms of COVID (compare with flu/cold, allergies)

Percentage of cases reported these symptoms. Source WHO and CDC

- Fever (88% of cases)

- Dry Cough (68%)

- Shortness of Breath (19%)

- Fatigue (38%)

- 20% or less reported the following symptoms; muscle and joint pain, sore throat, headache, diarrhea, vomiting, and phlegm.

A person that has been exposed to the

COVID-19 virus may not present symptoms for at least 2 days and up to 14days post-exposure. It is important to practice

the following prevention measures and check your temperature frequently.

Prevention is Key!!!!

In order to protect our hospitals’ capacity, we must “flatten the curve”

- This means we have to slow down the spread of the disease so that too many people don’t get sick all at once.

- Stay home (even if you are healthy) and do not interact with others outside of your home.

Since there is no vaccine to prevent the disease, the only way to “flatten the curve” is to isolate ourselves and exercise social distancing.

- Going out into public areas for ESSENTIALS like getting groceries, medication, or doctor’s appointments.

- Practice social distancing and keep at least 6 FEET distance from others. If your job allows it, work from home.

The CDC explains additional ways you can protect yourself and others, including

- Wash your hands often for at least 20 seconds with soap and water

- Use alcohol-based hand sanitizers, when water and soap are unavailable.

- Cover your mouth when coughing and sneezing: Avoid touching your eyes, nose, and mouth with your hands.

- Clean and disinfect frequently touched surfaces or common areas (For transportation workers, please disinfect car seats and door handles in between passengers)

- If you work with the public wear a mask and gloves (especially when handling money)

- Avoid public transportation: Avoid using public transportation, ride-sharing, or taxis.

Who Needs to get tested?

If you have the following symptoms

- Fever (100.4 or higher) + Shortness of breath AND a cough + exposed to someone who has COVID-19 = Get Screened for COVID-19

- Negative flu test + Fever (100.4 or higher) + Shortness of breath AND a cough = Get screened for COVID-19

If you develop emergency warning signs for COVID-19, call 911 for medical attention immediately. Emergency warning signs include*:

- Difficulty breathing or shortness of breath (wheezing)

- Persistent pain or pressure in the chest

- New confusion or inability to arouse (open eyes and awaken)

- Bluish lips or face (any discoloration on face and hands)

*This list is not all-inclusive. Please consult your medical provider for any other symptoms that are severe or concerning.

If you think you might be sick: (stay home – call PCP or hotline- if an emergency go to ER)

If lots of people get sick and many of them end up needing hospital care, resulting in overburdening America’s healthcare system.

- meaning we will not have enough beds, medical equipment, or doctors and nurses to help everyone.

- This may occur if the disease spreads too quickly

- People are getting infected at a much faster rate then they are being healed- putting a huge strain on the healthcare system.

Please call your healthcare provider or the

Atrium Health NC’s COVID-19 Helpline at 1-866-426-3821

Novant Health 24/7 Helpline at 877-966-8268

Mecklenburg County Public Health department at 980-314-9400

For individuals who do not have insurance or a primary care provider (PCP), here is a list of community-based clinic services.

Community & Financial Resources

COVID-19 is a global pandemic that is causing lots of disruption to many businesses and industries worldwide. The agencies below are offering limited assistance to ease some financial tension during this difficult time:

- Utility services: The following utility agencies will NOT suspend services for non-payment (you will still have to pay your utilities with additional rates/interest but services will not be cut if you cannot afford payments right now)

- Crisis

Assistance Ministry

- Provides limited financial assistance for families in crisis

- NOTE: CAM is closed

as of March 17th, however, you may request assistance once they reopen

- Mecklenburg County courts will not issue evictions or foreclosures for at least 30 days.

- Food Pantries

- Loaves and Fishes – Provides up to one week of emergency food assistance for you and your family

- Second Harvest Food Bank – Provides emergency food assistance

- Spectrum offering 60 days free internet for new households with students affected by COVID-19

- CVS and Walgreens waiving fees for prescription home deliveries (other pharmacies may offer home delivery for a fee)

- Unemployment

Insurance Benefits

- Governor Cooper waived some requirements that may make it easier to get unemployment benefits if you are laid off due to the COVID-19 pandemic.

- You can apply for benefits here or call 1-888-737-0259 for questions

- Charlotte-Mecklenburg

Schools

- CMS will provide free grab and go lunches for children under 18 at different locations across Charlotte

- Virtual Learning Resources: Not yet available as of 3/16 – see your school’s homepage for details

- Verizon

announced (March 13),

for the next 60 days

- it will waive late fees that any residential or small business customers

- Will not terminate service to any residential or small business customers because of their inability to pay their bills due to disruptions caused by the coronavirus.

- Low Income Energy Assistance https://www.mecknc.gov/dss/admin/Pages/Low-Income-Energy-Assistance-Program.aspx

Learning from Home

- K-12:

- Virtual Learning Resources tools

- Khan Academy – Free

online resource

- Has developed a daily curriculum schedule for students.

Working from Home

- Frequently check your

email for updates from employer:

- Enroll/Apply for CODVID-19 Relief aid and assistance, if applicable to your household.

- Review of Human Resource policy

- COVID-19 information

is changing constantly, Stay Informed!

- Mecklenburg County Offices (including Dept. of Social Services)

- NOTE: county offices are closed for in-person assistance, but staff are still available by phone or online

Medical or Other Emergency

- Call 911

ECAC Hotline for Essential Needs in the Event of Lockdown

Please call or text this number if you or a family member needs additional information or help to get the following items: groceries and water, medications or first aid supplies from the pharmacy.

😷 SPREADING THE INFORMATION, not the virus 😁

ቫይረሱን ሳይሆን መረጃውን ያሰራጩ!!!

*Disclaimer: Information is constantly updating- please refer to resource list for the most up to date information